Business Seminar Series

The School of Business hosts a seminar series each semester where Manhattan University students and faculty, as well as leading scholars and professionals, present on current business topics.

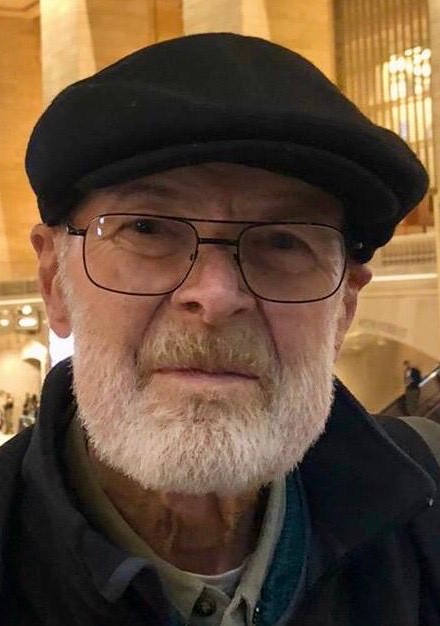

Prof. John F. Tomer Business Seminar Series

For the 2023-24 year, we honor Prof. John F. Tomer, Emeritus Professor of Economics. A pioneer in the area of behavioral economics, Tomer served Manhattan University for 29 years. He published 5 books and over 60 peer reviewed articles and was a founding member of the Society for the Advancement of Behavioral Economics (SABE).

For the 2023-24 year, we honor Prof. John F. Tomer, Emeritus Professor of Economics. A pioneer in the area of behavioral economics, Tomer served Manhattan University for 29 years. He published 5 books and over 60 peer reviewed articles and was a founding member of the Society for the Advancement of Behavioral Economics (SABE).

The seminars are held weekly throughout the semester. Presenters can range from economists from the Federal Reserve Bank of New York, to scholars from Yale and Columbia, or even our very own Manhattan University community.

Fall 2023:

Date |

Name & Institution |

Title |

|

Sebastiano Manzan |

“Forecasting GDP in Europe with Textual Data” | |

|

Michael North |

“Addressing an Aging, Multigenerational Workforce” | |

|

Boris Gershman |

“Headhunting and Warfare: Evidence from Austronesia” | |

| Daniel Dench Georgia Tech |

“Were Covid-19 shutdowns good for maternal, fetal and infant health?” | |

| November 1 | Alexandros Vardoulakis US Federal Reserve Board |

“Leverage and Stablecoin Pegs” |

| November 8 |

Hany Guirguis and the Fed Challenge Team Manhattan University |

“The US Economic Outlook and the Current Advances in Monetary Policy” |

| November 15 |

Marco Ranaldi University College London |

“Fractal Theory of Income Distribution” |

| November 29 | Maria Fernanda & Rosales-Rueda Rutgers University |

“Does Delivery of Primary Health Care Improve Birth Outcomes? Evidence from the roll-out of Community Health Centers.” |

| TBA |

Melina Kourantidou |

TBA |

Past seminar topics have included:

- A Synthesis of Behavioral and Mainstream Economics

- What is socialism today? Conceptions of a cooperative economy

- Gaming or Gambling? An Empirical Investigation of the Role of Loot Boxes Addictions in Video Games

- Inequality and Business Cycles

- Decision Making for Sustainability: A Holistic Way Forward

Past Seminar Series

Below are previous Seminar Series Speakers and Events, categorized by year.

-

2023 (Spring)

Date Name and Institution Title February 8

Tiania Homonof

New York University“Administrative Burden and

Procedural Denials: Experimental

Evidence from SNAP”March 1

Jay schwarz

Comcast NBC Universal“Doing Economics and Policy in

Washington”March 8

Beia Spiller

Resources for the Future“Charging Stations and the City” March 22

Lauren Aydinliyim

Zicklin School of Business Baruch College

“Public Policy-Induced Changes in

Human Capital Factor Market

Imperfections: How Non-Compete

Policy Affects Firm Market Value”March 29 Jing Dong

Graduate School of Business

Columbia University

“Waiting Online versus In-Person in

Outpatient Clinics: An Empirical Study

on Visit Incompletion”April 5 Shane Timmons

Economic and Social Research Institute, Ireland

“A Social Structural Theory of

Organizational Responsiveness to Social

Issues: CrossFit in the Crosshairs”April 19 Enrico Forti

Manhattan University

“A Social Structural Theory of

Organizational Responsiveness to Social

Issues: CrossFit in the Crosshairs”April 26 Marguerite Gallagher, Clark Hayes, Kelly

Cwik, Joseph Demauro

Faculty Advisor: Hany Guiguis

Denis Muller

Faculty Advisor: Dr. Haoran ZhangHenrique Mittelstadt

Faculty Advisor: Georgios KoimisisThieke Fellowship Presentations:

1. Can the Phillips Curve provide

answers to current high inflation

rates caused by Covid-19?2. The Rise of Retail Traders in the

Options Market: Evidence from Stock Splits3. International Capital Flows,

Growth and Innovation: The Role

of CultureMay 3 Alin S Tomiaga & Students

O'Malley School of Business Manhattan University

Team presentation for the upcoming

BAC@MC competition

-

2022

Fall 2022

Date Lecture Title Speaker(s) Affiliation September 21 Jose Minaya MC alum and CEO of

Investment firm Nuveen

(A TIAA company)September 28 “Discovering "Product Gaps" in the

Market”Alex Burnap Yale School of Management October 5 “Hospitality and Wine: Building on our

experiences in Greece”Grishma Shah and Students on

the OMSB Greece ImmersionManhattan University October 12 “Trapped in gender? Ambiguity

aversion, gender congruence, and

career choices”

Chen LiErasmus University Rotterdam,

NetherlandsOctober 19 Sandra Black Columbia University October 26 “Money (Not) to Burn: Payments for

Ecosystem Services to Reduce Crop

Residue Burning”Seema Jayachandran Princeton University November 2 Fed Challenge Team Presentation Hany Guirguis &

Fed Challenge TeamManhattan University November 9 Navid Asgari Gabelli School of Business

Fordham UniversityNovember 16 “The Diffusion of Steam Power” Martin Rotemberg New York University November 30 “Are Current Disclosures Current?

Evidence from Form 8-K Impairment

Filings”Amanda Sanseverino Manhattan University Spring 2022:

Date Lecture Title Speaker(s) Affiliation February 2 "Sectoral shocks and mismatch unemployment" Laura Pilossoph Federal Reserve Bank of New York February 9 "Preferences and Productivity in Job Matching: Theory and EMpirics from Internal Labor Markets" Bo Cowgill

Columbia University February 16 "New Listing Alert: Alternative Theory of Housing Search" Sophia Gilbukh Baruch College February 23 "Public Company Auditing Around the Securities Exchange Act" Thomas Bourveau Columbia University March 2 "The Impact of High Skilled Immigration on Regional Entrepreneurship" Jorge Guzman Columbia University March 9 "Protest Matters:The Effects of Protests on Economic Redistribution" Belinda Archibong Barnard College March 23 "Inequality and Business Cycles"

Andrea Tambalotti

Federal Reserve Bank of New York March 30 "Why Financial Literacy Matters. Lessons from Five Years of P-Fin Index Data"

Annamaria Lusardi

George Washington University April 6 "Been there, felt that…or have I?: Why previously endured distress reduced compassion action quality towards others currently enduring similar distress"

Reut Livne-Tarandach

Manhattan University April 13 "Power Distanced, Power, and Corporate Social Responsibility"

Edy-Moulton Tetlock

Manhattan University April 27 Thieke Fellowships Part I: "ESG Reports, Disc Golf, and Misleading Disclosures"

Jimena González Ramirez, Amanda Sanseverino, Kelly Cwik, Robert Mack, Rosalia Ross

Manhattan University May 4 Thieke Fellowships Part II: "Price Discovery and Inflation Prices"

Hany Guirguis, Patrick Brady, Christopher Machol

Manhattan University

-

2021

Spring 2021:

Date

Lecture Title Speaker(s) Affiliation February 17 Firing Costs and the Decoupling of Technological Invention and Post-Invention Investments Daniel Keum School of Bsusiness, Columbia University March 10 Mobile Push versus Pull Targeting in Location-Based Advertising: Evidence from a Field Experiement Dominik Molitor March 17 Multiple Selves Rudy Henkel Business and Economics, Ursinus College March 24 Limitations on the Effectiveness of Forward Guidance in the Wake of the COVID-19 Pandemic Arunima Sinha Department of Economis, Fordham University April 21 Tax Literacy and confidence in a US College Population: Relations to accounting and tax education Crystal Xu, Hanni Liu and Aaron Kim School of Business, Manhattan University April 28 Polarization and Group Cooperation Andrea Robbett Middlebury College May 5 Conflicting Interests and the Effects of Fiduciary Duty - Evidence from Variable Annuities Shan Ge Stern School of Business, New York University Fall 2021:

Date Lecture Title Speaker(s) Affiliation 15 September Capitalism, Alone Branco Milanovic CUNY Grad. Center & Stone Center on Socio-Economic Inequalities 22 September What is socialism today? Conceptions of a cooperative economy John E. Roemer Yale University 29 September The yield curve: Obtaining corporate spreads using Bloomberg Kudret Topyan Manhattan University 6 October A Synthesis of Behavioral and Mainstream Economics Nobel Laureate Yisrael (Robert J.) Aumann Hebrew University, Israel 13 October 2021 Characterizing Transnational Violoence in Sub-Saharan Africa William Foote Manhattan University 20 October Exploring and pricing equity options with Bloomberg - OMONM & OVME Functions Amira Annabi Manhattan University 27 October The US Economic Outlook and the Current Advances in Monetary Policy Hany Guirguis and the Fed Challenge Team Manhattan University 3 November Gaming or Gambling? An Empirial Investigation of the Role of Loot Boxes Addiction in Video Games Andrey Simonov Columbia University 10 November Equity Valuation: Estimating the Intrinsic value of equity assets using Bloomberg Hany Guirguis Manhattan University 17 November Firm Boundaries and Voluntary Disclosure Thomas Burveau Columbia University 1 December Transparency in Collaborative Projects Ruth Beer Baruch College 8 December Decision Making fior Sustainability: A Holistic Way Forward Poonam Arora and MBA Students Manhattan University -

2020

Spring

Date Lecture Title Speaker(s) Affiliation February 5 Strategic Alliances and Voluntary Management Earnings Guidance Practices Sebahattin Demirkan School of Business, Manhattan University February 12 Student Presentations form the winter experiential trip to Dubai/AbuDhabi Grishma Shah and Students School of Business, Manhattan University February 26 Is Size Everything? Asani Sarkar Federal Reserve Bank of NY March 11 Three Tales of Trust: How Cognition, Emotion and Group Dynamics Shape Trust Judgments and behavior Tamar Kugler Eller College of Management, University of Arizona March 25 Siblings Rivalry: Zero Sum Dynamics of Managerial Power and Resource Allocation in Business Groups Daniel Deum Columbia University April 1 An EZ way to evaluate assets Georgios Koimisis School of Business, Manhattan University April 8 Statistical Significance in Finanical Timeseries Forecasts Florin Spinu Pivotal Path Fall

Date Lecture Title Speaker(s) Affiliation September 16 Careers in Economics: There Can Be a Good Life After college for Business Economics Miles Cary Leahey Manhattan University September 23 Optimal public debt indexation in advanced economics Patricia Gomez -Gonzalez Fordham Univeristy September 30 Cash-Forward Arbitrage and Dealer Capital in MBS Markets: COVID-19 and Beyond Asani Sarkar Federal Reserve Bank of NY October 14 Extemporaneous Coordination in Specialist Teams: Evidence from Exogenous Assignment in E-Sports Enrico Forti Manhattan University October 28 Fundamental Soruces of the Time Variation in Equity Risk Levels Petra Sinagl Tippie College of Business, University of Iowa November 4 Navigating Current and Future Monetary Policy through COVID-19 Hany Guirguis and the Fed Challenge Team Manhattan University November 18 Push versus Pull Technologies in Location-Based Mobile Targeting: Evidence from Field Experiments Domonik Molitor Gabelli School of Business, Fordham University December 2 Geographic Segment Reporting Incentives: The Role of Anti-Corruption Regulation Amanda Sanseverino Manhattan University -

2019

Spring

Date Lecture Title Speaker(s) Affiliation January 30 “Solvency Analysis: Assessing Avoidance Risks in LBOs, Dividend Recapitalizations or Spin-Offs” Manish Kumar Goldin Associates February 6 "Doing Business in Paris", “What are the implications of the gas tax in France?”, “Government interference in business operations, France vs US”, “What are the downstream effects of automation on the automobile industry in France?” Audrey Corcoran, Kevin Stagno, Dominique Palagruto, Andrew Antaki, Lauren McManus, Madison Beames, Morgan Graziano, Francesca Iorio, Mark Pompa Students in the 2019 O’Malley School of Business Study Abroad Trip, Manhattan University February 20 “Wealth Creation” Thomas D. O’Malley ’63 former chairman of Manhattan University’s board of trustees March 13 “Lessons in Business Efficiency, Performance, and Financial Growth” John Abplanalp, former CEO and President of Precision Valve Corporation March 27 “A Comprehensive Review on Logo Literature: Research Topics, Findings, and Future Directions” Min Jung Kim Manhattan University April 3 “Why Consumers Are Not Sovereign: The Socio-Economic Causes of Market Failure” John Tomer Professor Emeritus, Manhattan University April 10 “Asymmetric Punishment as an Instrument of Corruption Control: Laboratory Experiments” Utteeyo Dasgupta Wagner College/Fordham University April 17 “Optimism and Skill in the Finance Industry” Markku Kaustia Aalto University, Finland May 1 “A Phillips Curve with Globalization and Anchored Expectations” Hany Guirguis and Zoe McGreevy Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 11 “Assessing IBISWorld as a Faculty Resource” Donald Gibson Manhattan University September 18 “Careers in Economics: There Can Be a Good Life After College for Business Economics” Miles Cary Leahey Manhattan University September 25 “Ambiguity and The Tradeoff Theory of Capital Structure” Yehuda Izhakian Zicklin School of Business, Baruch College October 2 “Using Big Data to Study Individual Differences and Decisions “in the Wild” Sandra Matz Columbia University October 16 Special Presentation for the Undergraduate Fed Challenge Fed Challenge Team led by Hany Guirguis School of Business, Manhattan University October 23 “Environmental Attitudes and Behaviors among Students” Jimena González, Sierra Arral, Heyi Cheng, and Veronica Cheng Manhattan University October 30 “Enhancing In-class and Online Course Design: Latest Tips and Trends” Kimberly J. Woodruff Director of Instructional Design, Blair Goodlin, Jr., Instructional Designer November 6 “Perceptions and Corrections for Social Desirability Bias” Nathaniel Burke University of Arkansas November 13 “National Culture and Corporate Sustainability” Edy Moulton-Tetlock (with Olga Hawn and Vanessa Burbano) Manhattan University December 4 “Sustainable Tourism: What it is, what can be done and what is a Lasallian response” Carolyn Predmore and Students Manhattan University -

2018

Spring

Date Lecture Title Speaker(s) Affiliation February 14 “Measuring the Impact of Monetary Policy on Mortgage Rates” Hany Guirguis and John Trieste School of Business, Manhattan University February 21 United Nations, Head of PRME Secretariat Lecture Jonas Haertle, Head of PRME Secretariat UN Global Compact Office February 28 “The Scientific Practices of Economics and The Emergence of and Trends in Behavioral Economics” John Tomer, Emeritus Manhattan University March 7 “The Wine Whisperer – How a Manhattan Alumni Is Using Her Foreign Language Skills to Start Her Wine

Business”(Co-sponsored by the Department of Modern Languages)

Sheila DonohueManhattan University Alumna March 21 “Asset Prices and Wealth Inequality in Complete and Incomplete Markets” Georgios Koimisis Manhattan University March 28 “Credit Market Choice” Or Sharkar Federal Reserve Bank of New York April 11 “Gendered stereotypes of unemployed professionals: Implications for reemployment” Jolie Terrazas and Michael Judiesch Manhattan University April 18 “Mutual Care in Late Life Marriage” Joan Monin Yale University April 25 “Redemption Option under the new Chapter 11” Amira Annabi Manhattan University May 2 “Cross-border M&As and Credit Risk: Evidence from the CDS Market” Iuliana Ismailescu Pace University Fall

Date Lecture Title Speaker(s) Affiliation September 19 “Asset Prices and Wealth Inequality in Complete and Incomplete Markets” Georgios Koimisis Manhattan University September 26 “Careers in Economics: There Can Be a Good Life After College for Business Economics” Miles Cary Leahey Manhattan University October 3 “New York Commercial Real Estate” Michael Flood Robert K. Futterman &Associates (RKF) October 10 Special Presentation for the Undergraduate Fed Challenge Fed Challenge Team Manhattan University October 17 “Your goals are my goals: An experimental look at low stakes goal setting and economic effort

among students”Nathaniel Burke University of Arkansas November 7 “Do Sin Firms Commit Accounting Sins?” Hanni Liu and Crystal Xu Manhattan University November 14 “What Impedes Efficient Adoption of Products? Evidence from Randomized Sales Offers for

Fuel-Efficient Cookstoves in Uganda”Andrew Simons Fordham University November 28 “The Effect of Communicating a Social-Political Stance on Employee Motivation: Field

Experimental Evidence from Online Labor Market Platforms”Vanessa Burbano Columbia University December 5 “Strategic Social Media and Use of Dashboards for Small Business” Carolyn Predmore and Students Manhattan University -

2017

Spring

Date Lecture Title Speaker(s) Affiliation February 15 “Adventures in Extreme Finance” William Foote School of Business, Manhattan University February 22 “International Real Yields” Andrey Ermolov Fordham University March 8 “Pedagogical Strategies for Engaging Millennials: A Panel Discussion” Janet Rovenpor and Amira Annabi, Poonam Arora, Angela Grotto, Gwendolyn Tedeschi Manhattan University March 22 “Data Analytics in Medical Imaging” Angel Pineda Department of Mathematics, Manhattan University March 29 “Gender Specific Risk Preferences, Intra-household Bargaining, and Investment Decisions:

Experimental Evidence from Rural Cameroon”(Maria) Jimena González Ramírez, Niccolo Meriggi, Manhattan University OMSB, Wageningen University and Research Center April 5 “Enabling Global Prosperity: A Case Study of Peruvian Gold” Joshua Fisher and a Panel of Speakers Director of AC4 Team, Earth Institute, Columbia University April 12 “The Economics of Flash Orders and Trading” Ethan Namvar Haas School of Business, UC-Berkeley and Columbia Business School April 19 “Are you happy to give or receive the gift cards? The effects of the money-view on the

preference on the gift cards”Min Jung Kim Manhattan University April 26 “Research for Economic Growth and Sustainability” Carolyn Predmore and Students Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 13 “Careers in Economics: There Can Be a Good Life After College for Business Economics” Miles Cary Leahey Manhattan University September 20 “What is value in an equity market?” Michael Suen, Ph.D., CFA and Chief Data Scientist, Hany Guirguis CWF Managers & Manhattan University September 27 “Cognitive Load and Economics” John Smith Rutgers University October 4 “What Determines Financial Knowledge among College Students?” Amira Annabi, M. Jimena González Ramírez, Fabian Mueller Manhattan University October 18 “Do multinational and domestic companies have different leverage ratios after considering their cash tax

payments?”Hanni Liu School of Business, Manhattan University October 25 “Measuring the Impact of Monetary Policy on Mortgage Rates” Fed Challenge Team Manhattan University November 8 “Bad Credit, No Problem? Credit and Labor Market Consequences of Bad Credit Reports” Paul Goldsmith-Pinkham Federal Reserve Bank of New York November 15 “Do Richer Foreign Work Experiences Lead to Entrepreneurial Success? Evidence from Survey Data” Dan Wang Columbia University November 29 “The Decline and Consolidation in US Retail Industry” Rose Klimovich and students Manhattan University December 6 “Twice the Vice: Choosing the Lesser Evil” Lauren Trabold Manhattan University -

2016

Spring

Date Lecture Title Speaker(s) Affiliation February 3 “City Squares Tours - San Jose Costa Rica Hop On Hop Off Bus” Carolyn Predmore and Students School of Business, Manhattan University February 10 “The Impact of U.S. Monetary Policy on Emerging Markets Exchange Rates” Carlo Rosa Senior Economist, Federal Reserve Bank of New York February 17 Special session for Job Talk : Environmental Economics Jordan Stanley Syracuse University February 24 Special session for Job Talk : Environmental Economics Taha Kasim Georgia State University March 9 “The Reach of Rank and Response: A Field Experiment on Peer Information and Water Use Behavior” Syon Bhanot Swarthmore College March 23 “Parenting, Teaching, or Peer Effect: An Experiment on Children’s Pro-Social Behavior” Natalia Londono CUNY March 30 “The profit impact of revenue heterogeneity & assortativity in the presence of negative word-of-mouth” Mohammad Nejad Fordham University April 6 Special session: Book Launch: “Integrating Human Capital with Human Development” John Tomer Emeritus Professor of Economics, Manhattan University April 13 “Working as a (Micro) economist in Washington” Jay Schwarz, PhD Deputy Division Chief and Economist, Federal Communications Commission April 20 "The Impacts of the Central American Free Trade Agreement on the Economy of Costa Rica" Students in ECON 444: Special Topics Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 14 “Careers in Economics: There Can Be a Good Life After College for Bus Economics” Miles Cary Leahey Manhattan University September 28 “A Multilevel Analysis of Organizational Restructuring: The Impact of Role Stressors and

Resources on Employee Strain Outcomes”Angela Grotto Manhattan University October 5 “The Real-Time Classroom” Niraj Kumar iDecisionGames.com October 12 “Financial Shock, Interbank Interest Rates, and Banking System Soundness” Mami Kobayashi Ritsumeikan University (New York University visiting scholar) October 26 “Conspicuous Consumption of Time: When Busyness and Lack of Leisure Time Become a Status Symbol” Silvia Bellezza Columbia University November 2 “Transition Dynamics of a Mass Deportation” James Feigenbaum Utah State University November 9 “Overview of the US Household Debt: 1999-2016” Donghoon Lee Federal Reserve Bank of New York November 30 “Why are firms sold? Evidence from acquisitions of European private firms” Natalia Reisel School of Business, Fordham University December 7 “Big Data for Small Businesses” Carolyn Predmore and students Manhattan University -

2015

Spring

Date Lecture Title Speaker(s) Affiliation February 11 “How a small energy consulting company could enter the U. S. Market: its differential advantages” Carolyn Predmore and Students School of Business, Manhattan University February 18 “Employment-Based Health Insurance, Uncertain Medical Expenses, and Aggregate Labor Supply” Kai Zhao University of Connecticut February 25 “Value Investing versus Low Volatility Investing” Josh Greco Equity Product Specialist, Legg Mason Global Asset Management March 4 “The Reach of Work Interruptions: Crossover of Affect in Couples” Angela R. Grotto School of Business, Manhattan University March 11 “Only Mine or All Ours: Do Stronger Entitlements Affect Altruistic Choices in the Household” Utteeyo Dasgupta Wagner College March 25 “The Over-the-Counter Theory of the Fed Funds Market: A Primer” Gara Afonso Economist, Federal Reserve Bank of New York April 1 “GSP Expiration and Declining Exports from Developing Countries” Shushanik Hakobyan Fordham University April 8 “The Drug Development Process: Selected Public Policy and Economic Considerations” Daniel Patrick Executive Director of Global Financial Planning & Analysis, Celgene Corporation April 15 “Context Matters: Role of Decision Frames in Interdependent Dilemmas” Poonam Arora School of Business, Manhattan University April 22 “A Multi-period Supply Chain Network Model for Biological Medicinal Products” Amir Masoumi School of Business, Manhattan University April 29 "Does Size Matter? The Effect of Institutional Size on Global Virtual Teams" Grishma Shah School of Business, Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 16 “A ToolBox for Visual Text Analytics: A twitter Case” Musa Jafar Manhattan University September 23 “High-Frequency Trading and Modern Market Microstructure” Ciamac Moallemi Columbia University September 30 “The Chinese Savings Rate: Productivity, Old-Age Support, and Demographics” Kai Zhao University of Connecticut October 7 “Application of Integrative Learning to Introductory Managerial Accounting” Fengyun Wu and Aileen Farrelly School of Business, Manhattan University October 14 “Sex and Candy: The Influence of Sexual Content and Consumer Trait Perceptions on Ad Evaluations” Lauren Trabold Business, Manhattan University October 21 “The Transatlantic Trade and Investment Partnership: Will it Set Trade Free in the North Atlantic?” Natalia Boliari School of Business, Manhattan University October 28 Special session for Fed Challenge Team Hany Guirguis and Students School of Business, Manhattan University -

2014

Spring

Date Lecture Title Speaker(s) Affiliation February 19 “First Price Auction with Three Bidders Affected by Information” Hyeon Park School of Business, Manhattan University February 26 “The New Face Time for Men and Women in High-Status Careers” Angela Grotto School of Business, Manhattan University March 5 “An Integrated Disaster Relief Supply Chain Network Model with Time Targets and Demand Uncertainty” Amir Masoumi School of Business, Manhattan University March 12 “Critical Incidents and Cases: A Student-Faculty Collaboration” Poonam Arora, Carolyn Predmore, Janet Rovenpor & Students School of Business, Manhattan University March 26 “Risk and Return in Baltic Equity Markets” Rokas Kirlys School of Business, Manhattan University

Supervisor: Kudret TopyanApril 2 “Eliciting Private Information with Noise: The Case of Randomized Response” Ernest K. Lai Lehigh University April 9 “Vaccination Games with Peer Effects in a Heterogeneous Population” Troy Tassier Fordham University April 23 “Birth, Death and Public Good Provisions” Jonathan Lafky Lafayette College April 30 “The Market for Innovative Business Techniques Hypothesis: The Interrelation Between

Supply-Side Organizations’ Broadcast of Innovative Business Techniques and Demand Side

Organizations’ Use of these Techniques”Alicja Reuben School of Business, Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 10 Jasper Research Scholars Presentations: Manhattan University School of Business “A Proposal to Research Manhattan University’s School of Business Passport

Program”Richard Meany Supervisor: Aileen Farrelly “Is There Really a Threat of Shariah in the Financial Industry: a Comparison

Between Conventional and Islamic Investment Vehicles”Gaensly Joseph Supervisor: Yassir Samra “Not all Legacies are Positive: Conservatism influences Allocation of Benefits and

Burdens to Future Generations”Tina Nitis Supervisor: Poonam Arora “Known versus Unknown Devil: Experience Influences Perception of Risk in Natural

Disasters”Nick Enright Supervisor: Poonam Arora September 17 “Street Smarts: The use of Psychological Techniques in Performance Improvement of Wall

Street Traders and Salespeople"Michael Carey Manhattan University September 24 “Exploring Content with Semantic Transformations using Collaborative Knowledge Bases” Yegin Genc School of Business, Manhattan University October 22 “Integrating Human Capital with Human Development: Toward a Broader and More Human

Conception of Human Capital”John Tomer Emeritus Professor of Economics, Manhattan University October 29 “The Fed Competition Rehearsal” The Fed competition team School of Business, Manhattan University

Supervisor: Hany GuirguisNovember 5 “The Role of Motivation in User-Generated Reviews” Stephen He School of Business, Manhattan University December 3 “Poverty in America and Products that focus on the Lower Income Levels” The Marketing Honors Seminar class School of Business, Manhattan University

Supervisor: Carolyn Predmore -

2013

Spring

Date Lecture Title Speaker(s) Affiliation February 6 “So Bacco: More than a Drink, It’s an Experience” Carolyn Predmore and MBA Students School of Business, Manhattan University February 13 “Resolution of Financial Distress under Chapter 11” Amira Annabi School of Business, Manhattan University February 20 “The Arches Program - Teaching Basic Micro with a Service Experience” Gwendolyn Tedeschi School of Business, Manhattan University February 27 “Lessons learned from the planning and execution of a large-scale merger” Dan Patrick Executive Director of Global Financial Planning & Analysis, Celgene Corporation March 13 “Isn't Money Green? ICT, RBV and the Broader Meaning of "Sustainability” Patrick Jeffers School of Business, Manhattan University April 10 “On The Economics of Drug War” Natalia Boliari and Matthew Claro School of Business, Manhattan University April 17 “Economic Decision Making: How our brain works” John Tomer Professor Emeritus, School of Business, Manhattan University April 24 “Housing and Asset Prices in an Overlapping Generations” Hyeon Park School of Business, Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation October 2 “Understanding through the Eyes of Others: Inferences Regarding Chosen and Forgone Products” Stephen He School of Business, Manhattan University October 9 “Is Walmart Good for India? A Humanistic Perspective on Opening Up FDI in

Multi-Brand Retail in India”Grishma Shah School of Business, Manhattan University October 23 “Enriching Undergraduate Managerial Accounting with a Brief Budget Simulation Game” Aileen Farrelly School of Business, Manhattan University November 6 “Relative Pay for Relative Performance” Chia-Jane Wang School of Business, Manhattan University November 13 “Islamic Finance in the U.S.: Development and Future” Abdullah Alqattan School of Business, Manhattan University November 20 “Sustainable Marketing and Eco Tourism” The Marketing Honors Seminar class School of Business, Manhattan University

Supervisor: Carolyn Predmore -

2012

Spring

Date Lecture Title Speaker(s) Affiliation March 28 “’Herd’ Behavior and the Bullwhip Effect: What You Know can Hurt” Patrick Jeffers School of Business, Manhattan University April 4 "Using Knowledge-BasedSystems to Model Complex Environments " Salwa Ammar and Carolyn Predmore, Ronald Wright, School of Business, Manhattan University, Le Moyne College April 11 “A Three Market New Product Consumer Potential Evaluation for a Less Chemically Based Hair Dye” Caitlin Frazer, Brian Korney and Joseph Fernandes

Supervised by Carolyn PredmoreSchool of Business, Manhattan University April 18 “Globalization, Collectivist Values and Gender: Understanding Career Aspirations in India” Michael Judiesch, Grishma Shah School of Business, Manhattan University April 25 “Brain Physiology, Egoistic & Empathetic Motivation, & Brain Plasticity: Toward a More Human Economics” John Tomer School of Business, Manhattan University May 2 “The True Value of Ownership: Lessons from Agribusiness in the Argentine Pampas” Stephen Edwards, (Junior), Janine Paliotta (MBA),

Supervised by Poonam AroraSchool of Business, Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 19 “Values, Voices and Viewpoints: The Role of Firm Communications on Marketing Performance” Monique Bell, Ph.D. Candidate Marketing, LeBow College of Business, Drexel University, Philadelphia, PA. October 3 “Endowment Effect and Goal Tradeoffs: A Field Study with Argentine Farmers” Stephen Edwards, Janine Paliotta, Keelan Ledwidge, Guillermo Podesta, Poonam Arora School of Business, Manhattan University October 10 “The Color of Money: Its Strategy and Broader Meaning of Sustainability in the New Economy” Patrick Jeffers School of Business, Manhattan University October 10 “Better Together or Alone? The Influence of Others on Consumer Goal Pursuit” Lauren Trabold, Ph. D. Candidate, Marketing Zicklin School of Business, Baruch College, CUNY. October 17 “The Effect of Baby Exposure on Consumer Risk-Taking” Eric Stenstrom, Ph.D. Candidate, Marketing John Molson School of Business, Concordia University, Montreal, QC, CANADA October 24 “A General Equilibrium Model of Decision Makers with Belief Dependent Preferences” Hyeon Park Manhattan University October 31 “The Role of Lay Theories in Consumers’ Susceptibility to Reward Points” Meng‐Hua Hsieh, Ph.D. Candidate University of Washington November 7 “Enduring Happiness: Integrating the Hedonic and Eudaimonic Approaches” John Tomer Manhattan University November 14 “Review of The Long Divergence: How Islamic Law Held Back the Middle East" Timur Kuran, Natalia Boliari Princeton

University Press, Manhattan University School of BusinessNovember 28 “Vengeance ” Naci Mocan Louisiana State University and NBER December 5 “Raising the Bar: The Business of Improving Healthcare” Carolyn Predmore and her team. Manhattan University School of Business -

2011

Spring

Date Lecture Title Speaker(s) Affiliation February 9 “The Significance of Shared IT Knowledge” Patrick Jeffers School of Business, Manhattan University February 23 What Causes Obesity? And Why Has It Grown So Much? An Alternative View” John Tomer School of Business, Manhattan University March 9 “Board Size and Firm Risk-Taking” Chia Jane Wang School of Business, Manhattan University March 30 Teaching to Read with Focus: The Quote Analysis Assignment” Natalia Boliari School of Business, Manhattan University April 13 “Over-compensate For You or Disengage From You: Group Identity Dissonance Interact to

Determine in Social Dilemmas”Poonam Arora School of Business, Manhattan University April 27 “Leverage ETF Trading Effects on REIT Share Volatility” Hany Guirguis School of Business, Manhattan University Fall

Date Lecture Title Speaker(s) Affiliation September 14 Orientation session for the upcoming Town&Gown meeting September 28 “The Facebook App Economy” Horn Hann, Siva Viswanathan, Robert H. Smith, Byungwan Koh Robert H. Smith School of Business, University of Maryland, School of Business, Manhattan University November 9 “A Failure of Fair Trade or a Market Failure? An example for a Basic Economics Course” Gwendolyn Tedeschi School of Business, Manhattan University November 30 “Globalization and the Rise of Work-Family/Family Work Conflict in India" Grishma Shah and Michael Judiesch School of Business, Manhattan University December 7 “Poverty through the Local Lens: A Comparative Analysis of Poverty Determinants between

Bihar and Gujarat”Meredith Mayer, Global Business Studies, Class of 2012, supervised by Natalia Boliari School of Business, Manhattan University -

2010

Fall

Date Lecture Title Speaker(s) Affiliation October 13 "The Effect of Alcoholic Beverage Exice Tax on Alcohol-Attributeable Injury Mortalities" Kudret Topyan; (with C.H.Son) School of Business, Manhattan University October 20 "Is there a Cooperative Advantage? Experimental Evidence on Economic and Social Variables as Determinants of Demand?" Morris Altman Professor of Behavioral and Institutional Economics, Victoria University of Wellington November 3 "Choosing Between Leasing and Debt and Leasign Puzzle Revisited" Chia Jane Wang (with Jane-Raung Lin, David De-Wai Chou and Fei-Chung Chueh) School of Business, Manhattan University November 10 "Gone Fishing: A Monte Carlo simulation tool used to demonstrate the importance of data analysis in responsible decision making" Salwa Ammar School of Business, Manhattan University November 17 "The Minimal Status Effect: Role of Status in Strategic Coordination" Poonam Arora (with David H. Krantz, E. Tory Higgins) School of Business, Manhattan University December 1 "Small Business Success Requires More than Guts, Planning is Required for Success: Spas in the U.S." Carolyn Predmore & Yassir Samra School of Business, Manhattan University December 8 "Computer Security" Walter Bagget School of Business, Manhattan University